Navigating Student Loans for New Brunswick Students

Understanding student financial assistance is one of the most stressful parts of applying for college. For prospective students in New Brunswick, the system is designed to be a supportive partner in your educational journey. Let’s tackle some common misconceptions and uncover the powerful benefits available to you.

In New Brunswick, the Student Financial Assistance Program is a collaboration between the province (NB Student Financial Services) and the Federal Government (through the Canada Financial Assistance Program). TSD works as a third-party funding agency, that just so happens to belong to the government. These programs work together to ensure you have the funding you need to succeed.

Dispelling Myths & Uncovering Benefits

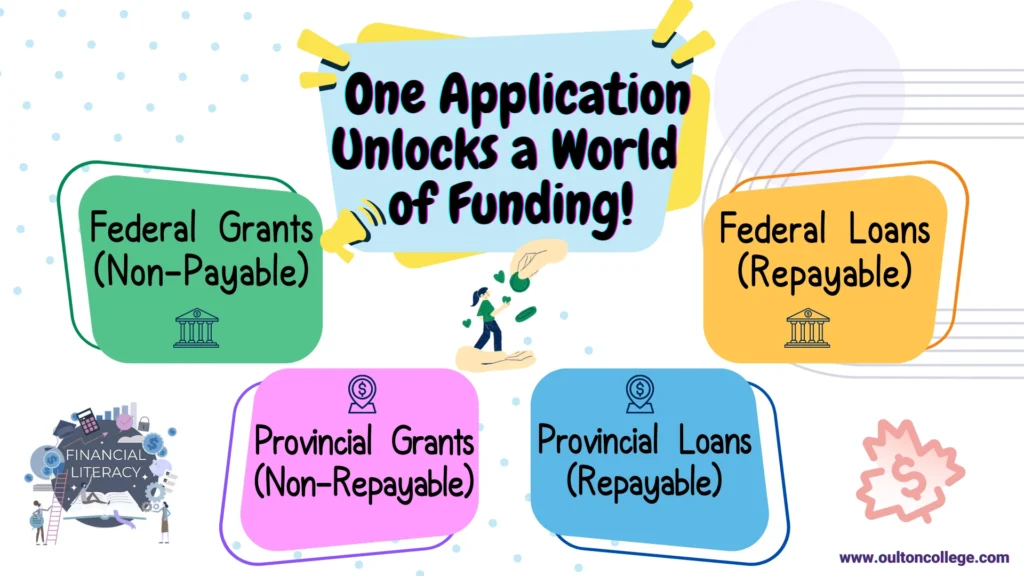

Myth 1: You have to apply for federal and provincial loans separately.

Fact: One application is all it takes to unlock a world of funding! When you apply for student financial assistance through the NB Student Aid Portal, you are automatically assessed for both federal and provincial grants, bursaries and loans. It’s a streamlined process designed to save you time and ensure you get the maximum amount of support. This integrated approach considers your financial need from all angles, making your path to an affordable education much clearer.

One Application, Two Loans: For New Brunswick students, you only need to submit one application to be considered for both federal and provincial funding.

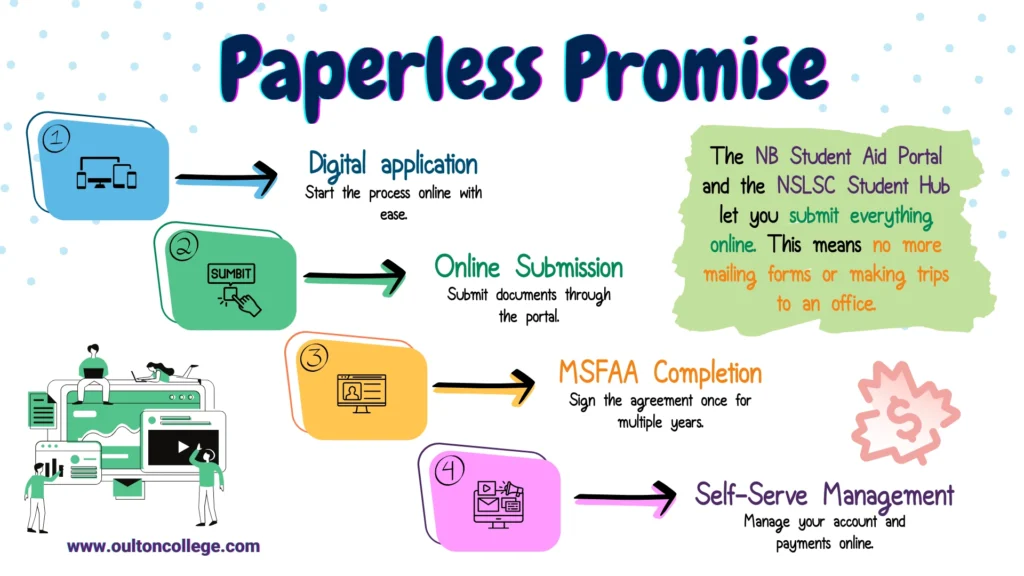

Myth 2: Applying for a student loan means endless paperwork and piles of documents.

Fact: The application process is designed to be surprisingly simple and digital, so you can spend less time on paperwork and more time on your future.

The Paperless Promise: The NB Student Aid Portal and the NSLSC Student Hub let you submit almost everything online. This means no more mailing forms or making trips to an office.

Sign-up Once, Done for Years: You’ll likely only need to complete your Master Student Financial Assistance Agreement (MSFAA) once. This multi-year contract covers all your loans, saving you from a yearly paperwork headache.

Self-Serve Simplicity: Your secure online account lets you manage everything from your payments to your personal information with a few clicks. It’s built for your convenience, not to create a pile of documents.

Myth 3: Student loans are just a high-interest debt like a bank loan.

Fact: A Canada-New Brunswick Integrated Student Loan is a powerful financial tool packed with unique, student-friendly benefits you won’t find anywhere else.

Zero-Interest Advantage: This is a huge benefit for students in New Brunswick! Both the federal and provincial portions of your loan are now permanently interest-free. As of April 1, 2023, for the federal portion, and November 2022 for the provincial portion, new interest no longer accumulates.

The Grace Period: After you finish school, you get a generous six-month non-repayment period to get on your feet. You are not required to make any payments during this time, and no interest is accumulating on either your federal or provincial loans.

Help When You Need It: The Repayment Assistance Plan (RAP) is your safety net. If you’re struggling to make payments after graduation, this program can lower your monthly payment—or even reduce it to zero—based on your income.

Forgiveness Programs: For those who meet specific requirements, New Brunswick and the federal government offer student loan forgiveness programs. Keep a look out for these!

You’re in control : You can customize your payment terms, make extra payments at any time without penalty, and manage your account online through the NSLSC.

Myth 4: Student loans are for full-time students with perfect grades.

Fact: Financial assistance is far more flexible and inclusive than you might think! The program is designed to support a diverse range of learners, not just those with high grades or a specific enrollment status.

Full-time & Part-time Students: You can be a full-time student (enrolled in at least 60% of a course load) or a part-time student (20-59%). Students with a disability are also considered full-time if enrolled in at least 40% of the academic load .

Financial Need is Key: Eligibility is based on a thoughtful calculation of your financial need, including your tuition, living costs, and personal contributions. The system is built to help those who need it most.

You’re in Control: You do need to maintain satisfactory academic progress to continue receiving aid, but you don’t need a perfect GPA. Your commitment to your studies is what matters.

Myth 5: You can apply at the last minute and still get your funding on time.

Fact: A little planning goes a long way in ensuring a smooth start to your academic year! To avoid any stress or delays, it’s highly recommended that you submit your application at least two months before your program begins.  This proactive step gives the system time to process your application and disburse your funds. By applying early each school year, you can focus on your studies instead of worrying about your finances.

This proactive step gives the system time to process your application and disburse your funds. By applying early each school year, you can focus on your studies instead of worrying about your finances.

Myth 6: Only Canadian citizen can apply for student loans.

Fact: The New Brunswick and federal student aid programs are designed to support a wide range of individuals with a legal right to be in Canada, not just citizens.

Canadian Citizens: As expected, you’re eligible if you are a Canadian citizen.

Permanent Residents: If you have permanent resident status, you are fully eligible for the same loans and grants as a Canadian citizen.

Protected Persons: Individuals designated as a “protected person” by the Immigration and Refugee Board of Canada are also fully eligible for financial assistance.

Myth 7: Permanent residents, have to wait a full year to apply for a student loan.

Fact: You don’t have to wait! The system is designed to help you start your education journey in New Brunswick right away.

Immediate Access to Federal Funding: The moment you receive your permanent resident status; you can apply for the federal portion of the student loan.

New Brunswick Residency Rules: To be eligible for the provincial portion of the loan and any provincial grants, you must be considered a resident of New Brunswick. This usually means you have lived in that province for at least 12 months without being a full-time student.

You can apply through the New Brunswick portal as soon as you’re a permanent resident. Your application will be assessed for federal funding, giving you the financial support you need to begin your studies while you work toward meeting the residency requirements for provincial funding.

Myth 8: You need endless documents to complete the online New Brunswick student loans application

Fact: The online application process for New Brunswick Student Financial Assistance is streamlined and designed to be user-friendly. While you do need to provide some documentation, it’s far from “endless” and most of it is standard for verifying eligibility.

Independent Student:

– Proof of identity.

– Social Insurance Number (SIN).

– Proof of residency in New Brunswick.

– Income tax information.

– Confirmation of enrollment.

– Banking information for direct deposits.

Dependent Students:

– Proof of identity; your own, parent(s) & any siblings.

– Social Insurance Number (SIN); own, parent(s) & any siblings.

– Proof of residency in New Brunswick.

– Parental Income tax information.

– Confirmation of enrollment.

– Banking information for direct deposits.

Students with Disability:

– Documents listed above.

– Disability Verification Form.

– Permanent Disability Expense Form.

– Separate application for the Canada Student Grant for Services and Equipment.

Myth 9: You can study for as long as you want.

Fact: While student financial assistance in New Brunswick supports your education journey, there are clear limits on how long you can receive funding.

Standard students: Up to 340 weeks of assistance.

Doctoral students: Up to 400 weeks.

Students with disabilities: Up to 520 weeks.

To continue receiving student grants and loans each year, you must maintain satisfactory grades and not have reached your maximum lifetime limit for financial assistance.

Book an Admissions Meeting Today!

Remember that by investing in your education, you are investing in your future, gaining the skills and connections you need to thrive in your career and life.

*Please note that information may be subject to modifications. We encourage current and prospective students to visit the websites in order to obtain the most recent information.